Tuesday January 10, 2017

Dow opens – 37 and our open trade falters a little (click to enlarge)

CLF (click to enlarge)

The DOW closes – 32 , This is what we closed out: CC + 1237, DDD + 3156, DGAZ – 4275, DRIP + 1960

TOTAL = + $2,078

The DOW closes – 43 , This is what we closed out: CF + 216, AKS + 180, CC – 675, AA + 1099, DDD + 2840, FAS – 480, FCX + 3540, SHAK + 3405, SPN + 1890, S + 1320, TNA – 63, TROX + 200, TXMD + 1170, X +1042

TOTAL = + $15,684

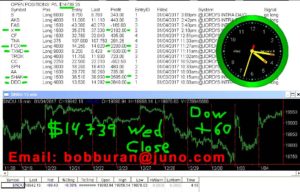

The DOW closes + 60 , This is what we closed out: UNT +315, DNR -1237, OCN + 1755, CIEN – 877, GTN -900, CF +253, EPE -4527, SYRG -2280, NAV +0, WPX -680, FAS + 799, DBD -225, TNA +483, FCX +1560, SN -240, WLL – 620, SPN + 1815, TROX + 2400, OAS + 852, AKS -440, SGY -5448, WNR – 1695, DGAZ + 17655, ATW + 1220, CF + 253, PAH – 990

TOTAL = + $9,201

TOTAL = – $3,822Dow opens + 27 and our open trade improves (click to enlarge)

KATE (click to enlarge)

KATE (click to enlarge)

The DOW closes – 111, This is what we closed out: CF + 75, ATW – 1160, CRC + 1437, EPE – 2925, KATE – 320, PAH -90, TNA – 839