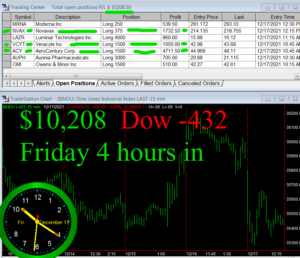

Friday December 17, 2021

The Dow opens -190 and our open trade jumps to 9 K (click to enlarge)

The Dow opens +167 and our open trade goes negative (click to enlarge)

After 30 minutes Dow is -16 and we are at -9 K (click to enlarge)

Total = -$14,307

After 30 minutes Dow is +4 and we are at +17K (click to enlarge)

Total = +$5,352

Dow opens +357 and our open trade leaps to almost 9 K (click to enlarge)

3 hours in (click to enlarge)

RGC (click to enlarge)

5 hours in (click to enlarge)

Total = +$3,483