The Subtle Art of Manual Trading

Reducing the Cost of Trading by Responding to a few Mechanical Trading Signals Manually.

Lets face it Stock trading costs can erode a stock traders’ profits seriously. This is particularly true for any trader that takes numerous trades on a daily basis. This article discusses strategies for eliminating transaction costs altogether. The article will be of particular interest to any serious short term stock market systems trader.

Is it possible to pay zero commissions when stock trading? Well yes and no. Right now I do not know of any broker that will execute orders for you for nothing. But there IS a way that you can use your skills as a trader to pay your broker and still execute the trade without it costing you anything.

Welcome to the subtle art of manual order execution. I have at times half jokingly called this “pajama trading”. Actually I frequently trade in my underwear, but “underwear trading” sounds a little kinky.

Theoretically If you could eliminate most of your stock trading costs you could change the way you trade reduce risk and make a lot more money. I think the “secret” to realizing this goal is first of all short term stock trading and that means taking a lot more trades. If you are the kind of stock trader that only takes about ten trades in a year and hangs onto stocks forever you can skip this article because you can afford to pay your broker $50 for a trade and do so with a lot of slippage and it will not change your bottom line very much. But if you trade like me and execute 10 to 30 trades per day you need to pay careful attention to both commissions and particularly slippage. It fact I am going to suggest that, with practice, you could pay for all your transaction costs with positive slippage.

First let us define some terms: Stock trading costs, for purposes of this discussion, are the commissions and fees you pay a broker to execute  your trade PLUS slippage. Slippage is the big ticket item and commissions are secondary. If you are trading $10,000 to $20,000 you need to limit your commissions to about $4 per round turn. But if you are trading a half million dollar account commissions are not so important and if you have to pay $15 per round turn it still is not going to make much of a dent in your profits. But small traders and big traders alike must deal with slippage and bad slippage can easily cancel out all the profits of a short term trader, big or small.

your trade PLUS slippage. Slippage is the big ticket item and commissions are secondary. If you are trading $10,000 to $20,000 you need to limit your commissions to about $4 per round turn. But if you are trading a half million dollar account commissions are not so important and if you have to pay $15 per round turn it still is not going to make much of a dent in your profits. But small traders and big traders alike must deal with slippage and bad slippage can easily cancel out all the profits of a short term trader, big or small.

Slippage is the difference between the price your trading system enters a position and the price you actually got when you execute an order in real time based on the trading system you are using. So if you place a resting order with your broker to buy 1000 shares of WOOPS at 1.00 stop and he fills the order at 1.01 your slippage is negative $10. The slippage is negative because that extra penny in slippage is costing you $10 more than the theoretical system trade and this must be added to your total transaction costs.

But slippage can also be positive. Rather than place a resting order with your broker you execute the order yourself “at the market.” And then the market pulls back a tick or two while you are placing your market order  and subsequently you may be filled at .98 rather than the system buy point of $1.00. In that case you save $20 and you can subtract that amount from the commissions and fees you pay your broker to execute your market order. The $20 you save is called positive slippage.

and subsequently you may be filled at .98 rather than the system buy point of $1.00. In that case you save $20 and you can subtract that amount from the commissions and fees you pay your broker to execute your market order. The $20 you save is called positive slippage.

In this case you, rather than the broker, may be making money when you add up your transaction costs. If the broker only charges you a $5 commission for doing a market order and you get $20 in positive slippage you are going to gain an extra $15 when this trade is closed out over and above what your trading system gains.

So how can you get positive slippage? To get positive slippage you need to practice a style of trading I call manual trading or “pajama trading”. I sometimes call it pajama trading because I do not have a regular job. I work at home sitting in front of a computer six and a half hours per day and keeping track of about 60 stock markets. My son is the only one that sees me so I wear what I want.

So how can manual trading while trading in your pajamas (or your underwear or ragged jeans) get you positive slippage and reduce your transaction costs to next to nothing?

Before answering this question let’s define some more terms: A RESTING ORDER is an order you place with your broker either by phone or electronically by way of a computer. There are basically three kinds of orders: 1) Market Order 2) Stop Order 3) Limit Order.

A market order is just that, it is an order to buy the market at what ever price the market is trading at right now. A market order is always filled. A stop order is a kind of order that becomes a market order only when a certain price is first hit. But a stop order is often filled at a price higher than where the stop is placed. However a stop order is always filled. A limit order is just that, it limits the price the order can be filled at and it cannot be filled at a higher price. The problem with a limit order is that it may not be filled. For a limit order to be filled price must first hit the limit price and then pull back a tick or two before moving higher. If it does not pull back a limit order will not be filled.

My experience is that limit orders do not work for entering a new position. The sacred rule of a system trader is that he or she MUST TAKE ALL THE TRADES. If you do not take all the trades you really have no system. S o limit orders do not work for system trading because limit orders cause you to miss trades. And to make the problem worse it has been my experience that the best trades, the trades that make the most money, do not pull back and allow limit orders to be filled. Limit orders cause you to miss the best trades.

o limit orders do not work for system trading because limit orders cause you to miss trades. And to make the problem worse it has been my experience that the best trades, the trades that make the most money, do not pull back and allow limit orders to be filled. Limit orders cause you to miss the best trades.

Stop orders on the other hand are always filled. Stop orders are what you usually place with a broker so you do not have to watch the markets. The problem with stop orders is that they are frequently filled at a tick or two higher than where the stop is placed. If a tick is worth $10 and you “are slipped” 100 ticks in a trading month it is going to add $1,000 to your transaction costs. You can only get negative slippage with stop orders and you will never get positive slippage. If there is positive slippage you can bet your broker will keep it.

So that leaves us with market orders. The great advantage of market orders is that you can get BOTH negative and positive slippage and the two tend to cancel each other out. And that brings us back to pajama trading. If you are sitting in front of your computers and your 1.00 buy price is hit you then hit the Buy-1000-shares-of-WOOPS-at-the-market button on your computer. Stock prices can change more than a hundred times in a single minute and sometimes your market order for 1000 shares of WOOPS will be filled at a price higher than 1.00 and sometimes it will be filled at a lower price. But unlike those resting orders placed with your broker it can go either way.

Regardless I still use stops often to enter trades. Unfortunately I am good at what I do but I am still human. When a stock screams through my buy price there is an all-too-human tendency to want to wait for a pull back that may never come. And that can result in my missing a great trade. Missing trades will not produce positive slippage! Missing trades is the worst mistake that I as a systems trader can make.

So in 2015 I am still using stop orders to enter all my trades. That assures me that I do not miss any trades even if I get a little slippage with each trade.

So where does the “pajama trading” come in?

The most effective pajama trading comes with exiting trades. I cannot possibly give you all the scenarios and all the rules here. You are going to have to watch the markets and make your own strategies that work for you. And keep in mind that my positive slippage comes from being right just a little more than being wrong. In other words I can and do make mistakes when I override the system.

But there are times when an early exit works. In general let me say that an early exit works best when you are taking big profits.

Generally speaking you are not going to do badly taking big profits sooner that the system does. This happens when a position that you have already entered takes off and the price literally goes off the top of the screen. This is usually news driven and there is panic among the shorts. You can sell into this panic and make a pile and what you take will frequently exceed what the system will get by waiting.

I will show you one of the most extreme examples of my trading career. This was a trade I took many years ago. I was experimenting with pajama trading at the time and only trading $15,000 cash ( $30,000 margin) with this account. Each trade I took only put $3,000 into each trade. With this I bought 4000 shares of a stock that had been trading at 80 cents a share the day before (Click to Enlarge).

My eyes bugged out when I saw this breakout start.

This was a drug research company and a false rumor had come out that it had discovered something very big. I entered this trade on a stop order with large slippage at about $1.40. I overrode the system and exited the trade 90 minutes later at about $2.70.

I made about $5,200 on the trade and increased my account size by about 30 % in 90 minutes!

The next day the rumor was exposed and price collapsed and the system trade went to a loss!

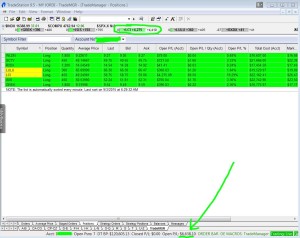

In September 2015 I did something similar with a managed account. On the close the day before, these positions were worth about $500. But the next day these positions jumped to over $6,000 on the open thanks to a huge gap up in LCI. I took my profits right there and then. I was glad I did because by the close these profits had shrunk to under $2,000. Click this image so you can open it and look at it:

By the way I should mention that in 2015 I rarely trade stocks under 5 dollars.

But in the first example I would like to point out that If I never did another pajama trade with this account all that year and did every other trade lock step with the system and entered and exited every other trade with a resting order, I would still have had positive slippage for the year. You just have to be right a few times to get positive slippage numbers.

So it is important to recognize that you should not override the system very much.

You just do it once in a while when you see exceptional things happen.

And it is safest to do when you are taking large profits.

You learn about exceptional things regarding markets by sitting in front of screens 6 ½ hours a day and watching them. There is no other way. Sometimes it gets very boring but be patient and try to think of it as “millionaire training.” Learn to be a “patient fisherman”.

Without any experience at all you will find you can reduce transaction costs by “pajama trading”. It is virtually impossible that you will not get some positive slippage by pajama trading if you only do it when taking big profits. But after watching markets for 6 ½ hours every day you are going to discover many things that will help you become a much better trader. By watching markets you can become a better trader with keen judgment and not be at the mercy of brokers.

Remember that nearly 70 % of my profits come from only 5 % of my trades and you need to watch for those great trades and learn how to play them. I take a lot of trades to find that handful of great ones.

Remember that nearly 70 % of my profits come from only 5 % of my trades and you need to watch for those great trades and learn how to play them. I take a lot of trades to find that handful of great ones.

I would like to think that years of pajama trading have made me a better trader. But what I do know for sure is that because of my pajama trading skills my stock trading costs are close to zero. And that makes a huge difference in profits if I am executing 10 to 30 trades a day. If you want to be a truly active trader and limit your risks by trading smaller positions in more markets you should consider pajama trading because pajama trading affords you the opportunity to dramatically reduce your stock trading costs

And believe me short term trading is much more profitable without stock trading costs being subtracted from your bottom line.