Boredom and High Return Investing

The Boredom of Making 50 to 100 percent Annual Returns on Your  Investments Year after Year

Investments Year after Year

The lure of trading excitement causes many traders to fail. The reality is that really effective high return investing may not be all that exciting. In fact boredom is an occupational hazard of high return investing. In order to really learn how to trade well and get really high returns you need to watch markets for hours every day. Yet for some this can be pure torture. It can be boredom brought on by a kind of sensory deprivation.

I once read about a police officer describing his late night shift in a big city. He said it was like eight hours of boredom with the possibility of one minute of terror. The officer was talking about police work, but he could have been talking about stock trading in front of a computer screen.

For example, it is Thursday, August 6, 2015. I got into 16 terrible positions yesterday and near the open this morning with the Dow plunging over 100 points I am massacred to the tune of $24,000. It is a relief to be out of everything but with the market falling I know I will not be getting into much today and I cannot see any possibility of an immediate change in these terrible markets.

Then I get into two trades, one in DDD and another in CPE. DDD seems  too high to go higher and I whimper as I see CPE sink to negative $3,000. Another terrible day and nothing good is going to happen. I try to distract my mind by watching stuff on You Tube while glancing occasionally at these dismal markets.

too high to go higher and I whimper as I see CPE sink to negative $3,000. Another terrible day and nothing good is going to happen. I try to distract my mind by watching stuff on You Tube while glancing occasionally at these dismal markets.

But DDD suddenly explodes and I am so bored and convinced that this is going to be a terrible day I ignore an opportunity to take a quick $4,000.

But my mistake wakes my mind up and rather suddenly CPE goes from negative $3,000 to positive $1,000. Now I stop watching You Tube and am transfixed as CPE climbs to over $7,000 in profits. What started out as a depressing boring day has ended with excitement and new hope.

Well I still lost a lot of money today. Should I hang it up? Should I give up? Well I do not think so. And this is why. If I look at my trading statistics for the whole year I am still doing better than some of the best fund  managers. In fact I could still hit my target of 50% to 100% for the year. But I cannot make mistakes like I did with DDD. I must stay focused on these stocks even when it is boring to do so.

managers. In fact I could still hit my target of 50% to 100% for the year. But I cannot make mistakes like I did with DDD. I must stay focused on these stocks even when it is boring to do so.

Watching stock markets on a screen is often not very exciting. Please read my article, The Subtle Art of Manual Trading. I estimate that about 70 % of my profits come from only 5 % of my trades. That means that about 95 % of my trades are not very exciting and that means about 95 % of the time this is pretty dull work.

But I am not going to be a great trader if I allow myself to be lulled to sleep. Opportunities in trading can be fleeting and the time frame requiring me to act might be only a few seconds. I need to stay alert and keep an eye on those screens for 6 ½ hours a day. That is my job and sometimes, yes, it gets boring, but the payoff, 50 % to 100 % returns, is huge. In reality no job is better than trading like this. If I want the big money I must learn to deal with the hours of boredom interspersed with a few minutes of high drama.

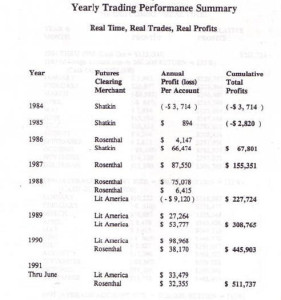

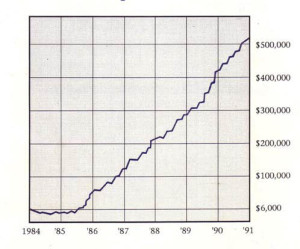

And dear people if you can maintain 50 to 100 per cent annual returns on your investment for five years you are going to be rich. It really hardly makes much difference what you start with. Quite a few years ago I wrote a book, “How I Quit My Job and turned $6,000 into a Half Million Trading”. Being as I was not a market guru at the time and nobody quoted me in the Wall Street Journal I figured nobody would believe me. So some of the book is simply copies of broker statements (click image to enlarge) to prove that I made well over 100% for six straight years in a ro w. And because I was not working any real job I took out most of the money to live on. So I did not maximize the compounding effect.

w. And because I was not working any real job I took out most of the money to live on. So I did not maximize the compounding effect.

So you think I was lucky? Do you think this was just a flash in the pan when the markets were different? Do you think this can be done with a small amount of money but the returns will be reduced as soon as one gets into big money?

Well I traded managed money for several years also and I pushed a couple billion dollars worth of trades through the marketplace. Most of this is on my web site. (see Stock Trading Millionaires) But guess what? I made over 100% trading millions of dollars also.

But the point I really want to make in this article is that back then in different markets and even when trading millions of dollars most of the trading days were boring and it does not make any difference how much money a person is trading or the markets they trade. Most trading is boring.

I have been researching all kinds of markets for nearly two decades and two major points of my research are these: 1) 85 % of the time markets move sideways rather than up or down. 2) Using the trading strategies that we use about 70% of our profits come from about 5% of our trades.

Do a little extrapolation from these figures and you can predict that nine out of every ten days of trading are going to be uneventful and not very exciting.

A good trader is someone who can sit there and follow the rules day after day after day. I talk to a lot of trader wannabees. When I tell them truthfully that I think it is quite possible for an average Joe to sit at home in front of computers and starting with a modest amount of money, to become rich in a few years, they start to salivate. That sounds so easy.

But quite surprisingly most would-be traders drop out because they expect a lot of excitement and what they get is such routine activity that it becomes boring. I frequently tell wannabe traders that one of the most important activities they must engage in is accurate record keeping (see Stock Market Record Keeping). I must spend at least 60 minutes at the end of each market day just doing spread sheets. Ho Hum, that is not very exciting, but if you fail to keep accurate records you will never be a good trader.

But one of the worst mistakes that bored wannabe traders make is to try to introduce excitement into the trading day by taking trades outside of the rules of of our methodology. They try to make trades that are not there. Without going into the many stories I have heard, let me just say that is the fastest track to trader extinction.

One of the great myths pushed upon would-be investors by financial advisors and brokers is that high returns on your investments mean high risk and that low returns mean low risk.

The one thing I have learned from my research is that risk and returns are not statistically related. High return investing does not have to be risky. What is related to risk and returns is the amount of trades taken  and the length of time those trades are held. (click image to enlarge)

and the length of time those trades are held. (click image to enlarge)

I have been able to get very high returns with low risk for many many years in all kinds of market environments. But to do this I must trade intensively day after day, week after week, month after month and year after year. And after all these years I put my stuff up on a web site every day, several times a day, to prove it. It’s right there day after day. I can’t fake it and you can’t argue with it.

But nevertheless most days are boring. Even doing high return investing and making 100 per cent every year is boring.

If you want excitement take up sky diving. But if you want to get rich and be a really good trader and be willing to do it on your own, you much commit yourself to years of just doing the same thing over and over again.

But trust me, if you can do that you will be financially rewarded beyond your wildest dreams.