High Returns and High Yawn: The Unexpected Monotony of Making 50 to 100 percent Returns on Your Investments

The thrill and lure of trading often lead traders astray. Successful trading and high return investing, contrary to popular belief, are often less about excitement and more about enduring long stretches of monotony. Indeed, boredom becomes an occupational hazard, an inevitable part of the journey towards high returns.

Embracing Boredom as Part of the Trading Process

The experience of sitting in front of the computer, observing market movements for hours on end can feel like a kind of sensory deprivation. The process can be equated to the description by a police officer about his late-night shift in a big city – eight hours of pure boredom punctuated by a minute of sheer terror. Just as his eyes were always peeled for signs of danger, a trader’s eyes are always peeled for signs of profitable opportunity.

Navigating Through Stormy Market Days

Take, for instance, the harrowing month of March 2023. Having found myself in 16 unfavorable positions, I witnessed the Dow Jones plunge over 400 points the next day. The plummeting figures were a massacre to my open trades, causing a very nasty loss of nearly $24,000. While it was a relief to be rid of these dreadful positions, the free-falling market offered little solace. I was acutely aware that the rest of the day held little promise for further profitable positions.

Persisting Through Market Volatility

Despite the bleak outlook, I ventured into two trades – one with 3D Systems Corp (DDD), the other with Callon Petroleum Company (CPE). DDD’s price seemed too steep to climb further, and as CPE’s value dipped into a negative $3,000, I braced myself for another day of disappointment. The markets seemed dismal, and I sought distraction in YouTube videos, only occasionally casting a glance at the plummeting figures.

The Thrilling Turn of Dull Days

My attention was brought back to the screen from my YouTube distraction when DDD exploded and CPE swung from a negative $3,000 to a positive $2,000. As CPE soared over $7,000 in profits, I was captivated. The dreary, monotonous day took an unexpected turn and injected a dose of excitement and renewed hope. Although I still recorded a loss for the day, the successful trades were morale boosters.

Trading Amidst Monotony: The Path to High Returns

Considering my trading performance from January to March 2023, I was still ahead of some top fund managers. Aiming for a 50% to 100% annual return was still within reach. However, maintaining focus during the mundane stretches was crucial.

Gleaning Insights from Hours of Screen Time

Scanning the stock markets isn’t always thrilling, but after clocking in two or three thousand hours, I’ve gained invaluable insights into market dynamics. My article, The Subtle Art of Manual Trading, delves into this further. Interestingly, about 70% of my profits come from just 5% of my trades, indicating that 95% of my trades—and my time—are rather dull.

The Highs Amid the Lows: The Reality of Successful Trading

It’s essential not to let the monotony lull me into complacency. Trading opportunities are fleeting, often requiring swift action within seconds. Despite the occasional boredom, staying alert during my 6.5-hour trading window is non-negotiable. This routine may get tiresome, but the reward—annual returns ranging from 50% to 100%—is substantial. No job surpasses trading in this aspect. To reap substantial profits, one must endure the lengthy periods of boredom punctuated by fleeting moments of intense action.

Building Wealth Through Consistent High Returns

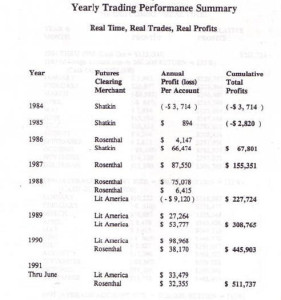

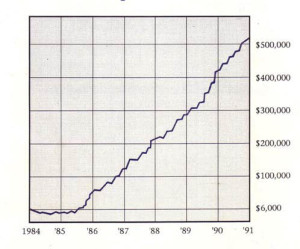

Achieving 50% to 100% annual returns over five years can significantly increase your wealth—irrespective of your starting capital. Years ago, I authored a book titled “How I Quit My Job and turned $6,000 into a Half Million Trading”. (CLICK THE IMAGE TO THE LEFT TO ENLARGE) As an unknown entity in the market then, I provided broker statements as proof that I had successfully made close to 200% annual returns for six consecutive years. Moreover, I had to rely on some of this income for living expenses, and so I was unable to leverage the full potential of compounding.

Many may perceive this as a stroke of luck, a flash in the pan when market conditions were different, or a feat only achievable with a small capital that would diminish with larger sums. But is that really the case?

Achieving High Returns Regardless of Capital Size

While managing portfolios for several years, I executed thousands of trades and pushed close to two billions of dollars through the market place. Details of my journey are shared on my website, Journey to Big Trading: Scaling from $6000 to Multi-Million Dollar Trades . Interestingly, despite managing vast sums, I still achieved over 100% returns.

The significant revelation I want to highlight is that, irrespective of the market conditions or the trading capital involved, most trading days were monotonous. Trading, for the most part, is a dull affair.

Trading Insights from Decades of Market Observation

After examining various markets for nearly forty years, I’ve reached two significant conclusions:

- Markets move sideways 85% of the time rather than in an upward or downward direction.

- Applying my trading strategies, about 70% of my profits arise from just 5% of my trades.

By extrapolating these figures, one can infer that about nine out of ten trading days will be uneventful and monotonous.

The Grind of Successful Trading

A proficient trader is one who consistently adheres to their trading rules day in and day out. When I share with aspiring traders the real potential for an average individual to build wealth from a modest beginning, their interest piques— the concept seems straightforward.

However, the routine nature of trading often leads to a high dropout rate among these hopefuls. They expect a thrilling journey, but what they encounter is a mundane activity. I regularly remind them of the critical importance of maintaining accurate records (see Stock Market Record Keeping). Every trading day ends with at least 60 minutes of spreadsheet work for me. This isn’t thrilling, but without diligent record-keeping, one cannot hope to excel in trading.

The Dangers of Chasing Excitement in Trading

One of the biggest mistakes bored aspiring traders make is seeking excitement by deviating from their trading rules. They try to force trades where none exist. From the countless stories I’ve encountered, I can assert that this approach is the fastest route to financial ruin.

A common myth circulated by financial advisors and brokers is the association of high returns with high risk and low returns with low risk.

Demystifying the Risk-Return Relationship

My research has led me to an important understanding: risk and returns are not statistically intertwined. High-return investing doesn’t need to be synonymous with high risk. What does correlate with risk and returns is the number of trades made and the duration for which these trades are held.

For years, I’ve managed to secure high returns with minimal risk, across various market environments. However, achieving this requires me to trade intensely and consistently: day after day, week after week, month after month, year after year. I’ve provided proof of this on my website, where I post my trades multiple times a day. It’s all there for anyone to see – it’s impossible to fake, and it’s incontrovertible.

Finding Fulfillment in Repetitive Success

Despite these accomplishments, most days are indeed monotonous. Even achieving high-return investing and making 100% returns annually can be tedious.

If you’re seeking excitement, try skydiving. However, if you want to accumulate wealth and become an exceptional trader, you must commit to years of repeating the same processes over and over again.

But believe me, if you can embrace this pattern, you’ll reap financial rewards beyond your wildest dreams.