The House Advantage: How Stock Trading Mirrors Gambling

Are You Gambling When Investing in Stocks?

The association between stock trading and gambling has often been the subject of my deliberation. A question frequently posed is: “Is investing in the stock market akin to gambling?”

Gambling, by its very definition, is engaging in a game of chance for money or stakes. Here, the outcome is determined more by luck than the skills of the participants. Chance, implying events occur without a specific cause, is the essence of gambling.

In stock trading, similarly, we encounter events that may seem to occur by chance. Yet, we acknowledge certain probabilities – some events are more likely to occur than others. Thus, the bridge between stock trading and gambling is built upon this common foundation of probability.

Investing in Stocks: A Gamble Worth Taking?

If we accept the premise that investing in the stock market is, indeed, gambling, it doesn’t necessitate an immediate halt to trading stocks. Rather, it demands a deeper comprehension of probabilities when trading stocks. The key lies in learning to tilt the odds in your favor when investing in the stock market.

We follow a trading system, JORDI (refer to automated stock trading software). This robust trading system consistently delivers good returns on our investment over time. However, it’s important to note that when tested across various markets over many years and approximately 10,000 trades, it emerges victorious about 56% of the time.

Understanding Trading System Accuracy

My study of these market statistics extends over nearly two decades. It has led me to conclude that given the predominantly random movement of the market, no practical trading system can be expected to exceed 60% accuracy. Claims of a trading system or market behavior predictions with 90% accuracy raise doubts about the credibility of such statements.

Hence, we operate within the realms of a system with approximately 56% accuracy. This article aims to demonstrate how a trading system with 56% accuracy can generate substantial profits with minimal risk. The comparison we’re drawing is between stock trading and casino gambling. However, there’s one crucial difference: in this scenario, WE ARE THE HOUSE!

Gaining House Advantage in Stock Trading

To comprehend this argument’s casino facet, one must familiarize oneself with the popular casino game – roulette. A roulette table boasts 36 numbers, divided evenly between red and black. At first glance, one might assume that betting $10 on a single number results in odds of losing at 36:1. However, despite multiple losses, one can break even when the ball eventually lands on the betted number, resulting in a payout of 36:1, or $360.

A closer examination of the roulette table reveals a twist – the presence of not just 36, but 38 numbers. This includes two extra slots, both green – 0 and 00. Should the ball land in one of these slots, the house sweeps the board.

This alteration significantly impacts the odds. It results in a house advantage at the roulette table of 5.3%, implying that the house will pocket $5.30 for every $100 bet at the roulette table.

No player can persistently win at roulette. Over time, the house is always triumphant, securing at least $5.30 for every $100 wagered.

Becoming ‘The House’ in Stock Trading

So, how do we shift roles and become ‘the house’ in the context of stock trading? The answer lies in accurately trading a system with consistent wins at a 56% accuracy rate. This presupposes that our average wins and average losses are roughly equivalent. With a 56% accurate system, our house advantage stands at 6%, translating to a gain of $6 for every $100 wagered.

Given this understanding, our trading strategy should focus on high volume. Our profits are a percentage of our wager, so the goal is to bet heavily. Currently, we’re operating in 96 markets, usually entering one day and exiting the next. We average about ten trades per day, each with a 56% likelihood of success. This strategy, akin to the ‘house’ in a casino, consistently yields good returns.

Trading Volume and House Advantage: A Personal Experience

An episode from my trading career further illustrates this principle. Over a two-year span, I generated over 5 million dollars in profits (refer to Big Trading), trading with an account of approximately 2 million. I made over 11,000 trades, the average trade value being only $385. However, the sheer volume of trading effectively pushed nearly two billion dollars through the stock market. A low house advantage can yield substantial earnings when it’s a percentage of such a significant amount.

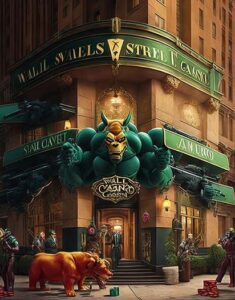

Building Your Own Wall Street Casino

How can you replicate this and establish your own ‘Wall Street Casino’? The first step is to disregard brokers, financial experts, and stock pickers. What you need is a reliable, computer-driven trading system. This system should have been tested across various markets and under diverse market conditions, with an accuracy rate between 50% and 60%. If the accuracy exceeds 60%, there’s likely an issue with your data or the system itself is dubious. Furthermore, diversification across numerous markets is essential, as is the volume of trades.

By adhering to these principles, you can effectively run your own Wall Street Casino and amass wealth. You now have become ‘the house’!

Investing in the Stock Market: Gambling or Strategic Betting?

So, is investing in the stock market gambling? The similarities between gambling and stock market investment are evident, considering both involve the potential for winning and losing, and both are influenced by probability theory. However, a critical difference exists. When gambling in a casino, the odds are perpetually stacked against you. Yet, with stock market investments, you have the power to reverse the odds, always working them in your favor. In the realm of stock market investment, you have the opportunity to relish the ‘house advantage’.