Investment Strategies: Understanding the Psychology of Successful Stock Investors

By Robert Buran

A Diverse Spectrum of Stock Investors

Stock investors embody a rich tapestry of different personalities, backgrounds, and approaches to trading. Some are extraordinarily successful, while others struggle to find their footing. The question then arises: how does the psychological profile of these disparate groups distinguish between the winners and the losers?

Before I ventured into the world of professional trading, my background was rooted in psychology. Naturally, I found myself intrigued not only by the explicit characteristics of stock investors but also by the underlying psychology that motivates their investment decisions. I yearned to delve deeper, to decipher what separates successful stock investors from their less successful counterparts.

A Case Study: The Rise and Fall of John MacAfee

Even among wealthy stock investors, the road to success is fraught with potential pitfalls. A notable example is John MacAfee, the pioneering mind behind the MacAfee anti-virus Software Company. A brilliant entrepreneur, MacAfee seemed to have the Midas touch in his business endeavors. However, about 15 years ago, his fortunes took a turn for the worse.

Eager for more autonomy, MacAfee sold his company, amassing a net worth of roughly 100 million dollars. With this sizable fortune, he set his sights on the world of investing. Unfortunately, his investments turned sour.

The Common Pitfall of Delegating Investments

MacAfee’s downfall underscores a common misstep that many wealthy individuals make. Although he demonstrated a fierce independence in his business endeavors, he relinquished control when it came to investing his hard-earned millions. Rather than embracing “do it yourself” investing, he entrusted his fortune to so-called “financial experts”, brokers, and financial advisors. In MacAfee’s case, one piece of advice led him to invest millions into bonds linked to Lehman Brothers.

As most people are aware, Lehman Brothers was one of the first casualties of the 2008 financial crisis. Its collapse sent shock waves through the global economy, and even after 13 years, many individuals, MacAfee included, were still grappling with the repercussions. The “expert opinion” had failed him, highlighting the dangers of turning over investment decisions to others.

A Misstep in Real Estate Investment

MacAfee’s financial woes did not end with ill-fated stock investments. He was also caught in the whirlwind of the 2008 real estate crash. Much like stock investors, real estate investors of the era were assured their investments were unassailable. They were led to believe that property prices were destined only to rise, a fallacy perpetuated by financial advisors, brokers, and government officials. Countless Americans, including MacAfee, fell prey to this misconception.

On June 23, 2021, MacAfee was found lifeless in a Spanish jail, having reportedly taken his own life. His unexpected demise ignited a flurry of speculations, with some speculating foul play.

Irrespective of the circumstances, MacAfee’s end was an unfortunate one. At the time of his death, his net worth was estimated at four million dollars, a significant decrease from the $100 million he held at his peak. This marked financial decline was largely a consequence of his decision to outsource his financial decisions.

While it is conjecture, one can’t help but question whether his drastic financial losses played a part in his tragic end. Moreover, would the course of his life have been different had he taken charge of his own finances?

The Psychology Behind Investment Decisions

So what psychological aspects of investment strategy contributed to John MacAfee’s decline, and the similar fate of countless others during the 2008 financial crash?

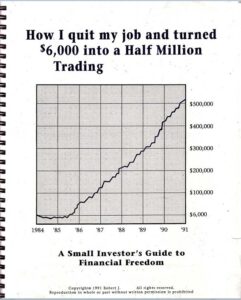

One potential factor is independent thinking. I delved into this concept in my book, “How I Quit My Job and turned $6,000 into a Half Million Trading.” I started with a meager $6,000, borrowed through a chattel mortgage from my bank, against everything I owned. This decision ran counter to conventional wisdom and almost all financial advice I had received.

Through approximately 10,000 individual trades, I managed to achieve nearly 200% annual returns for six consecutive years. Despite needing to withdraw money for living expenses, I ended up amassing half a million dollars in six years, from an initial investment of just $6,000. The story of this journey, backed by my broker statements, caught people’s attention.

I’m not sharing this to boast, but to illustrate how this journey made me contemplate the psychology of investment, risk, return, and the often misguided “expert opinion”.

I was far from an expert. My investment strategy was born on a yellow legal pad during a ski trip, requiring nothing more than a fifth-grade level of math to comprehend. I wasn’t an expert, but in many ways, I was miles ahead of those who claimed to be.

Four Key Strategies for Stock Investors to Enhance Returns and Performance

I won’t attempt to recapitulate my book in this article, but I can share four vital strategies that fueled my success as an investor:

- Develop your own strategies: I disregarded nearly all advice from others and charted my own course. My methods frequently contradicted the entrenched principles of financial trading.

- Embrace short-term investments: I never held onto an investment for more than three days. This approach insulated me from severe losses; if a particular stock took a nosedive, I was able to exit while I still had funds left. There’s significant safety in short-term trading.

- Diversify your portfolio: I traded across numerous markets, understanding the importance of diversification. While one or two investments may falter, it’s unlikely that all will stumble simultaneously. I can vividly recall a day when I lost $18,000 in bonds, but simultaneously earned $24,000 in stocks. Diversification was my safeguard.

- Be a self-reliant investor: I conceptualized my strategies, executed my trades, and accounted for my finances independently.

Among these, the most crucial strategy is self-reliance. There’s an inherent “lone wolf” nature required for successful stock investing. While contrarians might not excel as employees or partners, they’re typically superior investors. Stock investment often rewards those with contrarian mindsets, while punishing those who follow the crowd.

Adjusting Strategies and Continuing to Grow

Today, my investment journey is less thrill-inducing. I don’t leverage my investments as heavily as I once did, and I exclusively buy stocks, avoiding short-selling altogether. As of 2023, the odds still favor rising prices. However, diversification remains a staple in my strategy, and I currently take trading signals from over 50 diverse stock markets.

My trading systems, though honed through continuous programming, don’t differ significantly from what I devised on a yellow legal pad during a ski trip a quarter-century ago. The old tactics continue to serve me well. I still adhere to the three-day holding period rule.

Sharing my daily trades on this website has become an enjoyable routine. I maintain a low-profile approach, catering to small investors. While I don’t profit daily, I generate earnings most months. This website is my retort to the misguided advice that ensnared John MacAfee.

To attain success, stock investors need to tune out the noise and sidestep the investment snares that often come from heeding others’ advice. Successful stock investing calls for a do-it-yourself mindset. Simplicity and logic are still powerful tools in crafting investment strategies. “Lone wolves” continue to profit. Diversification is a real safeguard. Short-term trading can boost profitability while minimizing risk. If you want to succeed as a stock investor, design your own strategy, disregard the ‘experts,’ and take charge. DO IT YOURSELF!