When Machines Ruled Wall Street: A Look Back at the Flash Crash of 2010

Introduction: The Dawn of AI’s Domination

The year 2023 may be remembered as the era when Artificial Intelligence (AI) became a household name. It was the year when the so-called “average Joe” began leveraging AI services such as ChatGPT, making the incredible power of AI accessible to virtually anyone with a computer and an Internet connection. While many found this newly discovered AI tool to be highly beneficial and intriguing, others perceived a darker shade.

The Fear of AI Overpowering Humans

The pervasive use of AI led some to ponder on its potential downsides. It was undeniable that AI demonstrated intelligence far beyond human capabilities. This realization brought with it an unsettling question: Should we fear AI? Could it turn against us?

These concerns led me to revisit an article I penned in 2015 about an event that could serve as a stark warning of an AI-dominated future: the Flash Crash of 2010. It seems an appropriate time to explore measures we might need to take to safeguard ourselves and our economy from an uncontrollable AI that could potentially turn against us.

Flash Crash of 2010: When Machines Commanded Wall Street

T.S. Eliot’s poetic prophecy in “The Hollow Men” (1925) encapsulates the potential end of the world in his haunting lines: “This is the way the world ends, Not with a bang but a whimper.” While scientists have speculated about potential apocalyptic scenarios, from untreatable epidemics to cosmic calamities, an intriguing and unconventional concept stands out: The “Hal Scenario”. This scenario involves the machines we created gaining control, leading to our destruction. Could Eliot’s metaphorical ‘Hollow Men’ be these very machines?

The Potential for an AI Apocalypse

Could an AI apocalypse truly occur? Personally, I believe it’s a plausible scenario. Hence, we need to scrutinize the development and control of these “machines of the mind” more rigorously.

We’ve already experienced a taste of the “Hal Scenario” on May 6, 2010. This fateful day marked Wall Street’s first encounter with a machine-driven Flash Crash. For a few terrifying minutes, machines appeared to govern the world’s largest economy, providing a grim preview of the potential power of AI.

The Mayhem of May 6, 2010

On May 6, 2010, the financial world witnessed an unprecedented phenomenon: the entire US equity market crashed, only to recover about 20 minutes later. The financial ecosystem had never before seen prices plunge so drastically and rapidly. That day, over 19 billion shares were traded across various markets, resulting in substantial losses for many investors.

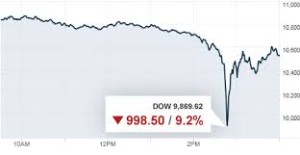

This is what it looked like:

Traders Paralyzed by the Flash Crash

The frantic pace of selling numbed traders, many of whom froze like deer in the headlights of an approaching vehicle. At 2:20 p.m. EDT, the Dow Jones was already down by 400 points.

Yet, the worst was yet to come. In a mere span of seven minutes, the Dow plunged an additional 600 points, marking the fastest and most significant drop in stock market history. Accenture’s stock exemplified this freefall, plummeting from $42.17 to 4 cents.

Despite this turmoil, the overall market did not stay suppressed for long. By 3:09 p.m., the Dow had recouped 700 points. Nonetheless, prices continued to fluctuate wildly until the market’s close.

Post trading, traders wandered aimlessly, their vacant expressions mirroring those of soldiers defeated by an overwhelmingly superior and invisible foe.

Machines in Command: The Onset of Automated Trading

Charlie Smith, the Chief Investment Officer at Fort Pitt Capital Group, aptly encapsulated the sentiment of that day: “I think the machines just took over. There’s not a lot of human interaction. We’ve known that automated trading can run away from you, and I think that’s what we saw happen today.”

This statement introduces an essential question: Was the flash crash a forewarning of the impending ‘Hal Scenario’? Could our financial systems and, by extension, our lives be dictated by these intelligent machines?

Public Attention Wanes: The Forgotten Flash Crash

Initially, the flash crash did command some attention. Even President Obama briefly commented on the largest stock market drop in history. Yet, it seemed as though this momentous event quickly faded from the public’s collective memory. Media coverage dwindled, and three years post the flash crash, numerous government investigations have yet to reveal the actual reasons behind the incident.

However, intriguing rumors have started to circulate.

Androgenic Syntactic Analysis: The Confluence of Human and Machine Intelligence

Machines, it is said, can replicate human thought processes and even emotions through a mechanism termed ‘Androgenic Syntactic Analysis’ or ASA. This method allows for a seamless translation of human cognition and communication into binary code, the language of machines and computers.

ASA, supposedly, facilitates the transformation of the most sophisticated facets of human intelligence into a digestible machine language. It can then be processed at lightning speed, networked, and compounded. As one unidentified source purportedly close to the government investigations remarked, “It’s like taking 100 of Einstein’s brains, networking them, and then having them capable of outputting a lifetime of Einstein’s ideas in a millisecond.”

While this information is intriguing, its authenticity and source remain unverified. It is presented here to spur discussion about the role and potential danger of intelligent machines in our society.

The ‘Hal Scenario’ Hypothesis

If we were to entertain this hypothesis, it suggests that the Flash Crash of May 6, 2010, might have been a precursor to the ‘Hal Scenario.’ For those few terrifying minutes, machines may have held absolute control over the American economy, perhaps even operating with an understanding of their actions.

Alternatively, this incident could be attributed to a programming error—a case of research animals briefly breaking free and causing chaos. Or it could simply be an instance of aberrant market behavior or random market theory gone wild.

The Inescapable Influence of Machines on Wall Street

I have posited that machines possess a superior grasp of Wall Street’s complexities than the human mind. As such, traders should allow their computers to make objective decisions rather than relying on their subjective judgment.

During the flash crash, our computers operated tirelessly, and we came out relatively unscathed. Was this merely good fortune?

Regardless of whether you believe in the ‘Hal Scenario,’ the reality is that thinking machines are increasingly dominant on Wall Street. These thinking machines have, and will continue to, assert control over our markets at times.

Should robots ever fully operate Wall Street, you’ll need your own robot to profit! Let’s hope the lessons from the Flash Crash have been duly noted.