High Return Investments in 2015

Most Americans have become weary of this slow economic recovery and may be searching for High Return Investments in 2015.

Many may be thinking of investment in the stock market, but few may have seriously ever thought of short term stock trading as a way to ramp up their income in 2015.

Like almost every year before, 2015 has been the subject of much speculation by the “doom and gloomers”. There are videos floating around the Internet with credible “financial experts” predicting that 2015 will be the year of the worst stock market crash in history and that investments in the stock market will lose at least 90% of their value. Forget the media hysteria and general stock market pessimism. I have been short term stock trading for over 20 years in all kinds of economic environments and I can tell you that short term stock trading can be a simple, effective and safe way to invest your money in the stock market while realizing high returns. In the year 2015 short term stock trading still works. And using money this way can become more than a simple investment it can become a full time job.

Long before the beginning of 2015 I started to do short term trading while I was working for a public school district. Within only five years I had quit my job to trade full time and was making far more trading than I ever dreamed of while working.

So what is it like to be a full time successful and experienced stock trader working for yourself and making a good living? Well this may surprise you but it can actually seem like a fairly boring job.

It is February 2015 and I am bored out of my mind. I am a stay-at-home stock trader which means I spend six and a half hours every trading day of the year in front of two computer screens trading about 60 stock markets on line. I do not get days off; I must do this every day. That is the downside; the upside is I work for myself. I roll out of bed every day and walk to my computers and I can get dressed or work in my underwear if I want. The only commuting I do is to the kitchen for coffee.

Today the DOW climbs out of a hole and gains 35 points. I closed out TOTAL+ $525 profit

BIG WOOP!

It’s a beautiful day and I would rather go fishing or skiing in the mountains, but instead I sit here for six and a half hours to make a few hundred bucks.

100 % Investing

Should I hang it up? Should I give up? Well I do not think so. And this is why. If I look at my trading statistics for the past 20 years or so and I add everything up, the good, the bad and the terrible I can see that I am making an annual equivalent of well over 100% annual returns a year on my investment. When the markets are moving like this I call it 100 percent investing.

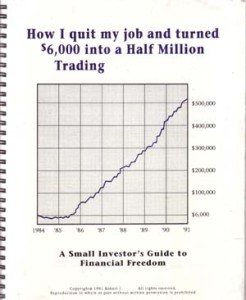

And dear people if you can maintain 100 per cent annual returns on your investment for five years you are going to be rich even if you start small. It really hardly makes much difference what you start with. Quite a few years ago I wrote a book, “How I Quit My Job and turned $6,000 into a Half Million Trading”. Being as I was not a market guru at the time and nobody quoted me in the Wall Street Journal I figured nobody would believe me. So half the book is simply copies of broker statements to prove that I made well over 100% for six straight years in a row. And because I was not working any real job I took out most of the money to live on. So I did not maximize the compounding effect.

So you think I was lucky? Do you think this was just a flash in the pan when the markets were different? Do you think this can be done with a small amount of money but the returns will be reduced as soon as one gets into big money?

Well I traded managed money for several years also and I pushed a couple billion dollars worth of trades through the marketplace. Most of this is on my web site. (see Stock Trading Millionaires) But guess what? I made close to 100% trading millions of dollars also.

And whats really exciting to me is that here in February 2015 the markets are almost as good as when I did that about 12 years ago. I cannot guarantee that 2015 is going to be this good for the rest of the year. 2012 was not very good. Even with my stock trading systems it is possible to have less than optimum stock trading performance. But even in 2012 we still made money.

But the point I really want to make in this article is that back then in different markets and even when trading millions of dollars most of the trading days were boring and it does not make any difference how much money a person is trading or the markets they trade. Most trading is boring. This is profitable, but it is not as exciting as you think.

I have been researching all kinds of markets for nearly two decades and two major points of my research are these: 1) 85 % of the time markets move sideways rather than up or down. 2) Using the trading strategies that we use about 70% of our profits come from about 5% of our trades.

I will say that again: 70% of our profits come from about 5% of our trades.

Do a little extrapolation from these figures and you can predict that nine out of every ten days of trading are going to be uneventful and not very exciting.

A good trader is someone who can sit there and follow the rules day after day after day. I talk to a lot of trader wannabees. When I tell them truthfully that I think it is quite possible for an average Joe to sit at home in front of computers and starting with a modest amount of money, to become rich in a few years, they start to salivate. That sounds so easy.

But quite surprisingly most would-be traders drop out because they expect a lot of excitement and what they get is so routine that it becomes boring. I frequently tell wannabe traders that one of the most important activities they must engage in is accurate record keeping. I must spend at least 60 minutes at the end of each market day just doing spread sheets. Ho Hum, that is not very exciting, but if you fail to keep accurate records you will never be a good trader.

But one of the worst mistakes that bored wannabe traders make is to try to introduce excitement into the trading day by taking trades outside of the rules of their trading systems. Without going into the many stories I have heard, let me just say that is the fastest track to trader extinction.

One of the great myths pushed upon would-be investors by financial advisers and brokers is that high returns on your investments mean high risk and that low returns mean low risk. It is no different in 2015 than 25 years ago. People think high returns in our soft economy are impossible and IF possible come with very high risk.

The one thing I have learned from my research is that risk and returns are not statistically related. High return investing does not have to be risky. What is related to risk and returns is the amount of trades taken and the length of time those trades are held. Short term stock trading is one of least risky of investments. If the market does crash in 2013 you are going to have one really bad day, but then you are going to be out of the market and standing aside still holding most of your money.

I have been able to get very high returns with low risk for many many years in all kinds of market environments. But to do this I must trade intensively day after day, week after week, month after month and year after year. And after all these years I put my stuff up on my web site every day, several times a day, to prove it. It’s right there day after day. I can’t fake it and you can’t argue with it. I have some good days; I have some bad days, but over time I make money.

But nevertheless most days are boring. Some days I hate doing my daily video. Even doing high return investing and making 100 per cent every year can be boring.

If you want excitement take up sky diving. But if you want to get rich and be a really good trader and be willing to do it on your own, you much commit yourself to years of just doing the same thing over and over again.

But if I can do this you can also. 2015 could be your lucky year. Why not make 2015 the year that you begin a new career and really learn about high return investments?

The following two tabs change content below.

![]()

Robert Buran