A Fresh Approach to Debunking Stock Trading Myths: Unraveling the Mystery of Price Movements

Part 1: Understanding Stock Market Mechanics and the Rule of the Screw

If you’re planning to tread the waters of stock trading, a thorough understanding of the stock market price and its fluctuating nature is critical. In essence, you need to discern what drives the stock market. My unique perspective on this subject introduces a principle I’ve coined as the ‘Rule of the Screw.’

The Rule of the Screw posits that stock market price movements are designed to counteract, undermine, and thwart the majority of market players’ best interests. Simply put, it asserts that the stock market will disregard technical indicators and fundamentals if the majority of stock market players act based on these signals.

Part 2: Embracing the Randomness in the Stock Markets

My belief is that stock market price movements are primarily random. While they may not be completely arbitrary, human emotions and judgment, including facets like algorithmic trading, significantly influence them. These various forces exert pressure on the stock market price, culminating in an unpredictable randomness that’s near impossible to foretell accurately.

Part 3: Exploiting Non-random Market Behavior – An Alternative to Technical Analysis

The ‘secret’ to profitable trading in a market ruled by randomness lies in identifying and leveraging the small segment of market behavior that’s not random. Traditional technical analysis, in my opinion, often fails to achieve this. This technique often fosters the illusion of unearthing hidden correlations between price behavior and various indicators.

However, these indicators are as random as the price behavior they strive to predict, leading to a random distribution of profits and losses. Hence, I consider technical analysis a pseudo-science.

Part 4: The Market Momentum Theory: An Analogy with Newton’s Laws

I propose an alternative to technical analysis, something I call the ‘Market Momentum Theory.’ (For a more detailed explanation, see my article Stock Trading for Dummies. The theory outlines two fundamental laws of price movement:

- If stock market prices rise, the likelihood of them climbing higher is more significant than falling lower.

- Conversely, if stock market prices fall, they’re more likely to plunge further than bounce back.

Part 5: Effective Trading Strategies and Overcoming Trading Psychology

From these two simple laws, the cardinal rule of trading emerges: buy when the stock market price ascends and sell when it descends. Many traders and aspiring traders fail to adopt this approach. Instead, they choose to buy when the market falls to secure a better price and hesitate to buy when the market rises because they perceive the price as too high. In doing so, they become a part of the losing majority.

Part 6: Dissecting the Common Misconceptions about Market Entry Points

The lure of perfect trading can often mislead even the smartest traders into committing what I call ‘trading suicide.’ They are led to believe in buying low and selling high, and end up falling prey to this illusion of perfection. However, successful traders understand that trying to time the market perfectly is a futile endeavor.

Instead, one should follow an established trend. If you decide to buy when the price rises, you might feel like you’re getting the short end of the stick. However, by ‘buying high,’ you likely align yourself with the minority and thus enhance your chances of making profits. In essence, you’re playing by the rule of the screw, and this strategy could be your ticket to success in the unpredictable world of stock market trading.

Part 7: Deconstructing the Illusion of Perfect Trading

Advertisement campaigns often paint a fantastical picture of their system’s capabilities, claiming they can buy at the lows and sell at the highs. However, this is merely a pipedream. Even seasoned traders understand that such an ideal scenario is unattainable. Yet, some fall into this trap because it feeds into their desire for perfect trading.

Upon analyzing any chart, our instinct is to buy low and sell high. However, it’s crucial to remember that you cannot consistently buy at the bottom and sell at the top. The more practical approach is to follow an established trend that aligns with your position’s direction. Any attempt to do otherwise is akin to committing ‘trading suicide.’

When you decide to buy a rising market, you may feel as if you’re entering at the worst possible price. It might not be a comfortable decision, nor will it look impressive on the charts. However, by ‘buying high,’ you’re likely aligning with the minority, thus potentially securing profits. In other words, you’re abiding by the rule of the screw.

Part 8: Mastering the Art of Exiting a Position

Just as important as entering a stock market position is knowing when and how to exit it. Popular exit strategies often fall short. Let’s consider two such strategies: the stop and reverse method and the trailing stop method.

The stop and reverse method involves using an indicator-based price. If the system is long one contract, and the market pulls back to the designated price, the system sells two contracts and reverses to a short position. As someone who’s traditionally opposed to shorting the stock market, I have found this strategy to be significantly flawed.

Part 9: Stop and Reverse Strategy: A Losing Game?

Using the NASDAQ futures contract as a test case and the Relative Strength Index (RSI) as an entry signal, I found that the stop and reverse strategy resulted in a loss over the past two years (6/14/21 to 6/13/23).

Moreover, it tied up margin capital 100% of the time, making it a suboptimal strategy.

Instead, I tested the same system using the same data (6/14/21 to 6/13/23), but made one significant change. I only went long and used the sell signal as an exit trigger for all my long positions:

The results showed a net profit, suggesting that this might be a more effective trading strategy, given the win-loss ratio was more than double.

Part 10: The Inefficiency of Stop and Reverse

Among the myriad of trading strategies I’ve examined, the stop and reverse strategy ranks as the least profitable and least margin efficient. Margin efficiency, which I’ll delve deeper into later, is vital because systems that remain in the market all the time tie up your margin needlessly (see my article,In and Out Trading) . As markets tend to move sideways about 85% of the time, these systems may leave your margin doing nothing for a significant amount of time, potentially leading to heavy losses due to sideways movement.

By contrast, systems like JORDI FUSION are very margin efficient. They only enter the market when significant movement is detected and usually exit the trade the following day, preventing unnecessary tie-up of your margin money.

Part 11: Stopping the Bleeding

What should you do, however, if your position starts out bad, get worse and then threatens an uncontrolled hemorrhage of your account equity?

Unfortunately this happens with some of our trades and our ability to keep these losses within a normal distribution pattern is what makes or breaks us as traders. This is a particularly critical issue if you are using Systems without stops on day of entry.

Out of frustration I developed a simple strategy that probably works better than anything I ever developed. If you are sick of always having your stops run, this simple strategy is going to be a big help. If you got into a trade based on a longer time frame such as a time frame based on daily data you need to develop a stop loss strategy that is based on a shorter time frame.

This is why JORDI FUSION is an improvement over my previous systems using only daily data. JORDI FUSION uses two data streams, daily data and 15 minute bar data.

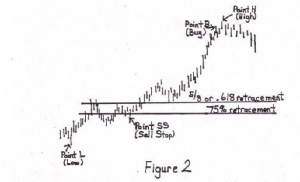

To see how looking at two different data streams can improve our analysis you should kick up a chart on your computer screen and set the bars to something like 3 to 10 minutes. If you are following our trading rules you are going to buy when the market goes up. This upward movement should create some kind of upward wave on the intraday chart. You should measure this wave from its top to its bottom and if you are long the market you should place your stop at the point that represents a 75% retracement of that wave. If you are short the market you simply reverse the process. Hence my rule for placing your protective stop is:

Place your protective stop at a point that represents a 75% retracement (5/8 or 6/8) of the wave that got you in.

Let’s look at an illustration:

Here again you see why the “buying high” strategy doesn’t sell systems. Buying point B (which is the high) looks like a terrible place to enter this market. Why not sell at point B? Or if we have to go long why didn’t we buy at point L (which is the low)? Don’t despair.

Because you feel that way others will feel that way also and so they, the majority of market players, won’t buy because it’s too scary. The market in the best tradition of the “Rule of the Screw” will sense this hesitation by the timid majority and move much higher. That will encourage the timid majority and they will then jump into this market in a buying frenzy.

At that time you will calmly sell your positions back to the frenzied majority and take your profits. The whole scenario looks something like this (click to enlarge):

But the real point I’m making is that when you first get into these trades they seldom look good and you need to use the 75% retracement rule to place a stop so as to give yourself some peace of mind. If you go back and look at Figure 2 you can see how this stop was calculated. I measure from point L (low) to point H (high) and take 75% of that and subtract that from point H to determine the stop which is equivalent to the price shown at point SS (sell stop).

Part 12: “Applying Fibonacci Ratios to Stop Placement”

The more perceptive of you may notice that I seem to be playing around with Fibonacci ratios. When we decide to place a stop at “75% retracement of the wave that got you in,” we’re essentially suggesting that if the market isn’t supported at the 5/8 or .618 Fibonacci retracement point, it’s a “Fibonacci failure” and signals a trend reversal. It’s at this point we need to steer clear of a collapsing market.

Trust me, you’ll be very pleased to have exited the market if these stops are hit, and it’ll be unusual for the market to “tag” these stops and then move upwards. This strategy proves to be our most effective stop-loss method.

Some of you who are technical analysts might feel a bit vindicated. Here I am, after having declared that technical analysis is largely nonsense, but I’m now using Fibonacci ratios for stop placement. Of course, the ratio .618 wasn’t conceived by a technical analyst. Known to ancient Greek and Egyptian mathematicians as the Golden Ratio or the Golden Mean, it was applied in the construction of the Parthenon and the Great Pyramid of Giza.

Part 13: “Summary and Conclusions Regarding Stock Price Movement”

These principles—if stock prices rise, there is a greater probability they will continue to climb, and if stock prices drop, there is a greater probability they will keep falling—are enduring, will not fail, and cannot alter in the future.

Upon initiating a trade based on these principles, we’ll dismiss traditional “stop and reverse” and “trailing stop” exit strategies. Instead, we will:

- Take profits only when the market is moving strongly in our favor.

- Place our protective stop at 75% retracement of the wave that got us in.

You may think these market theories are overly simple to be practical. However, before dismissing these ideas, I encourage you to download my 10-plus years of trading results with the JORDI systems, available at the very bottom of the home page of the website. This performance is as good as trading gets when compared with most.

I gleaned these rules from the marketplace and while attending the “School of Hard Knocks.” They may appear simple on the surface, but implementing them in the marketplace is a more complex process.

These principles can be seamlessly integrated into your short-term stock trading. Later, I’ll show you how you can consistently gain an edge on the stock market and automate a stock market trading system using these same straightforward rules. Using these strategies and principles of stock market price, you needn’t worry that these fundamental rules will fail or cease to function. They can’t stop working anymore than Newton’s Law of Gravity can stop working.

Consider revisiting my market momentum theory in the article,Stock Trading for Dummies.

I genuinely believe that if we stop obsessing over complex charts and formulas and focus instead on simple up and down stock market price movement, we can outperform the best trading professionals. Call this approach back-to-the-basics trading or any name you prefer. I call it financial security.