Stock Market Basics: Dummies Can Be Winners Too

Embracing the Simplicity of Stock Trading

I admit it, I’m a novice in the world of stock trading. And in 2023 the mantra of keeping it simple, or KISS as it’s often referred to, is still a guiding principle in my journey. There’s a vast sea of stock trading ideas out there, and it feels like an army of people are waiting to tell you the “right” way to trade. But here’s some encouraging news – you can tune them out and enhance your chances of stock trading success.

I admit it, I’m a novice in the world of stock trading. And in 2023 the mantra of keeping it simple, or KISS as it’s often referred to, is still a guiding principle in my journey. There’s a vast sea of stock trading ideas out there, and it feels like an army of people are waiting to tell you the “right” way to trade. But here’s some encouraging news – you can tune them out and enhance your chances of stock trading success.

Being a beginner in the stock market isn’t something to be disheartened about. In fact, it might just be your ticket to making real gains in the stock market.

The Fallacy of Financial Experts in Stock Trading

Many highly intelligent individuals work in the stock trading industry. They range from stock brokers to financial advisers. But, let’s uncover a little-known fact. When it comes to the forces causing losses in the stock market, nothing outweighs the advice of these so-called financial experts and brokers.

Interestingly, there seems to be an inverse relationship between a person’s intelligence and effective stock trading. It almost seems like the more intellectual someone is, the better they become at devising strategies that end up losing your money in the stock market.

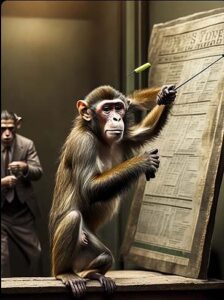

The performance of stock brokers in selecting profitable stocks is so questionable that it’s often compared to monkeys throwing darts at a page of stock listings in the Wall Street Journal. Therefore, the first lesson for a beginner in stock trading is to take control of your own trading decisions.

The Importance of Making Stock Trading Decisions Yourself

Steer clear of stock brokers in their polished shoes and pin-striped suits. Don’t let the fancy attire fool you – mastering stock trading for beginners involves taking charge of your own decisions.

Remember, your journey towards becoming a successful stock trader begins with embracing your status as a beginner and learning the basics. This could be your key to unlocking significant profits in the stock market.

The Perils of Relying on Technical Analysis

When navigating the stock market, I suggest giving technical analysis a wide berth. I often dub it as the ‘wiggly line theory.’ This so-called science of market behavior often serves as a promotional tool for a multitude of unscrupulous brokers and financial advisors, who bear more resemblance to snake oil salesmen. Technical analysis enthusiasts aren’t limited to these individuals; they span across trading system vendors and software companies.

Some brokers and market gurus treat technical analysis like a religion, a mysterious doctrine they champion to explain the inexplicable facets of the markets. In my eyes, it’s nothing more than a placebo for the legions of stock market losers. Hence, I’ve coined the term ‘WIGGLY LINE THEORY’ (for a more detailed discussion, see my article on ‘Stock Market Price’).

Advocates of technical analysis often propagate convoluted theories, such as instructing you to purchase XYZ stock when the 15-day moving average intersects the 45-day moving average, and to reap profits next year when the stock enters an ‘overbought’ zone – only if the stochastic endorses the sell signal.

I call it pure hogwash, financial jargon dressed up to look profound. Technical analysis is no more scientific than studying cloud formations. Both have their aesthetic allure and can appear to have structure and meaning. But, akin to clouds changing shape with the wind, these perceived patterns and meanings dissolve with market fluctuations and are quickly forgotten. Trusting technical analysis to dictate your investments is not a wise strategy.

You might question, “If financial experts employ technical analysis, why shouldn’t I use this methodology for my stock market investments?” Here’s my response: In its most straightforward terms, technical analysis falls short not due to its complex math or flawed formulas, but because it attempts to make sense of largely random data. Short-term stock market movements are primarily random. Regardless of how advanced your analysis techniques are, making sense of random data is challenging. Essentially, it’s a case of garbage in, garbage out. The randomness of the markets thwarts technical analysis, leaving even the most confident and knowledgeable financial experts and traders defeated.

Take solace in your status as a stock market novice. If you can’t understand it, you can easily drown out the noise and avoid unnecessary confusion.

Understanding Market Momentum Through the Lens of a Pool Table

Allow me to draw an analogy from pool to elucidate. In pool, one player initiates the game with a break shot, hitting the cue ball with the cue tip, propelling the ball towards the rack on the opposite side of the table. The cue ball’s final resting place is unpredictable—it could land anywhere on the table, drop into a pocket, or even bounce off onto the floor. However, the original momentum of the ball, from one side of the table to the other, implies a higher likelihood that the ball will come to a stop on the side opposite from where it was initially struck.

This theory is readily transferable to stock market movements. Let’s first define a “significant price movement” and label it as the “cue ball condition.” In our hypothetical market, the “cue ball condition” is satisfied if the price elevates by five dollars. Let’s assume that a market closes at a specific price on Monday. On Tuesday, the market meets the “cue ball condition” by escalating five dollars, so we decide to buy at that price. Applying the earlier discussed market movement theory, we opt to consistently sell our Tuesday-acquired positions at the opening on Thursday.

So, what’s the outcome? Over time, we’ll see profits, with approximately 55% of our trades turning out to be successful. But why?

By initially identifying significant momentum, we effectively turn stock market price movement into a cue ball hurtling towards the opposite side of the pool table. Although there’s no guarantee that the ball will always land on the other side of the table, momentum theory suggests it’s more probable than it bouncing back. In a similar vein, a stock that meets the “cue ball condition” on Tuesday is more likely to open higher on Thursday. If we sell at this point, there’s a high chance we’ll make a profit.

Personal Experience: A Testament to the Theory

You might ask, “How can you be sure?” My confidence comes from testing this elementary idea extensively and executing similar strategies thousands of times. In one two-year span, while dealing with around two and a half million dollars, I executed about 10,000 trades and moved millions of dollars through the marketplace, yielding around five million dollars in profits.

Interestingly, I didn’t use a trading system that was 95% accurate. Instead, I relied on a straightforward system based on market momentum theory, which succeeded about 55% of the time and failed around 45% of the time. Acknowledging the randomness of short-term stock market price movement, I knew 55% was about the best accuracy ANYONE could realistically achieve. I accepted this 55% accuracy rate, which led to nearly 100% annual returns on the funds invested and nearly five million dollars in profits over two years.

The Joy of a 5% “House Advantage”

So, a 55% accuracy rate isn’t bad at all. If you can trade consistently with 55% accuracy, you have a “house advantage” of 5%. This means that for every $100 you push through the market, you’re going to make $5. It’s akin to owning your own casino, where YOU ARE THE HOUSE. (See my article, Is Investing in the Stock Market Gambling?)

Additional Guidelines and Strategies

Now that we have a robust theory of market movement that can potentially benefit us stock market beginners, let’s add a few more crucial rules and strategies.

- Mechanical Trading System: With this theory in hand, it’s time to develop a mechanical trading system and commit to following it for at least one year. (See my article, Introducing JORDI FUSION )

- System Programming: Implement your system into a program that can run on a computer. As a stock market beginner, let your computer do the thinking for you. You don’t need to understand technical analysis; you simply need to trust and follow your computer. You don’t even have to think about markets; just execute the orders your computer instructs you to place. (See my article, Introducing JORDI FUSION )

- Diversify: Spread your investments thinly across many markets. We follow 96 markets and are sometimes invested in as many as 35 at a time. Market diversity can safeguard you from abnormal price movement, a common risk of trading in unpredictable markets.

- Two to Three Days Trade Duration: Limit your trades to two or three days. Just like a cue ball struck and brought to a stop, the move is short-term, as is stock market price movement based on momentum theory and probability. Momentum theory often concludes by day 3, sometimes earlier. There’s significant safety in limiting your trades to two or three days. You’ve surely heard tales of people losing everything in the stock market. Let me reassure you that the only people who lose everything are those who let brokers make their trades for them and refuse to sell their stocks. By making it a rule to ALWAYS exit after two or three days, you avoid becoming a stock market casualty.

So, stock trading for beginners might just be the path to follow. Disregard the experts, trade simple concepts you understand, and let your computer do the thinking. By adhering to these rules for stock trading for beginners, we can potentially outperform Wall Street and render “the suits” obsolete. Stock market beginners can indeed be wealthy!