Simple Stock Trading

Simple Stock Trading is the key to making the big money.

The randomness of short term stock behavior can only be tamed with simple trading systems using very limited parameters; trading and making money is easier than you think.

KEEP IT SIMPLE STUPID.You have probably heard of KISS, keep it simple stupid. When it comes to stock trading no advice could be better. In fact I am of the opinion that simple stock trading is the only way you can consistently make money in the stock market.

If you get the chance you should read my longer article, How to Trade. In that article I tell about a brilliant engineer who believed he could write a trading formula that could accurately predict all market movement. He anticipated that the formula would run about 50 pages in length.

The engineer was not successful. The problem is that markets are not perfect and in fact most short term stock movement is random. The most sophisticated formulas cannot predict random price behavior. It is garbage in and garbage out. You may wish to read my longer article, Stock Market Price.

So to deal with markets that are predominantly random you need to use formulas that are very simple with limited parameters.

EXAMPLE OF A SIMPLE STOCK TRADING SYSTEM

Let me give you an example of a stock market trading system with few parameters. At the close of a market day you take the LOW of the day and subtract it from the HIGH of the day. Next you take half of that value and add it to the CLOSE. So let us say that on Monday WUZOO makes a high of 20, a low of 10 and closes at 14. Then we will subtract 10 from 20 to get 10 and take half of that to get 5. Then we will add 5 to 14 to get 19.

The number 19, (.5(H-L)) +C, is the market price to buy on Tuesday. If the buy price is hit on Tuesday you hold the position until the open on Thursday and then you sell it. That’s it. There is nothing more to this simple system with the most limited number of parameters.

Then I tested this simple system. I randomly selected four markets from the top of my list of traded markets that are arranged alphabetically. The four markets I selected were ADCT, ADSK, AMD, and ABGX.

I tested each market using this simple trading system for one year. I used a formula that commits $10,000 to each trade, hence you buy 2000 shares of a stock trading at $5.00 and you buy 200 shares of a stock trading at $50.00 etc. I tested ADCT, ADSK, and AMD from mid January 2009 to mid January 2010. As a check against correlated markets I tested ABGX from mid August 2000 to mid August 2001.

In the real world of stock market trading and trading on margin you could probably trade all four of these markets at the same time with about $10,000 in your trading account. Furthermore it is unlikely you would ever get a margin call on a trading system that is out of the trade on the open of the third day. By the time the margin clerk calls you are out of the trade.

This is the net profits from each market: ADCT $2,376, ADSK $2,401, AMD $4,308, ABGX $7,299.

If I put the numbers for all four markets together this is what they look like:

Gross profit = $35,604

Gross loss = $19,219

NET PROFIT = $16,385

NET PROFIT AFTER TAKING OUT $50 PER TRADE FOR TRANSACTION COSTS = $10,835

Number Trades = 111

Number win = 72

Number loss = 39

Percent profit = 65 %

Average Trade (win loss) = $148

MAX intraday drawdown = -$2,848

SIMPLE STOCK TRADING CAN MAKE YOU RICH

So the bottom line is you are making conservatively $10,835 and that translates into over 100% annual return on your investment of $10,000.

If you compound $10,000 for five years you get $1,208,221

If you can commit yourself to sitting in front of computers for five years you can become rich by using simple trading systems like this.

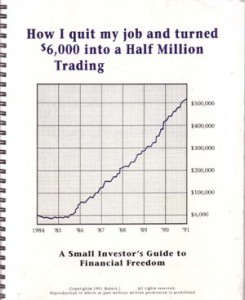

I am not just playing around with numbers and idle trading ideas either. I have already done this. I wrote the book How I Quit my Job and Turned $6,000 into a Half Million Trading and I published my broker statements to prove I had really done this.

I made over 100% for six consecutive years. The reason that I did not total over one million dollars was that I had to take money out of the account to live on.

I refuse to believe that I am the only person in the world that can consistently follow any one of these simple stock trading systems and I have integrated software and market data to make it easy for others to trade this way also. (Please see, Automated Stock Trading Software).

The point of this post is that stock trading is not complicated and a smart trader will simply tune out all the bogus stock experts and keep it simple (KISS). Believe me Simple Stock Trading can make you rich!

![]()

Robert Buran